How To Build an AI-Powered Financial Assistant App

How To Build an AI-Powered Financial Assistant App

일자

상시

유형

아티클태그

Financial well-being makes us feel confident and secure. However, managing personal money is a challenge. Nobody would refuse to hire a professional financial assistant for this job. Imagine access to an expert who knows your spending behavior, can tell you how to save money, how to increase capital and how to achieve your financial goals. And what if such an assistant is powered by artificial intelligence and can do all this right from your smartphone?

If you were looking for a guide on how to build such an AI financial assistant app, then you are on the right page. Here you will find answers to the most common questions related to the development of a financial management application.

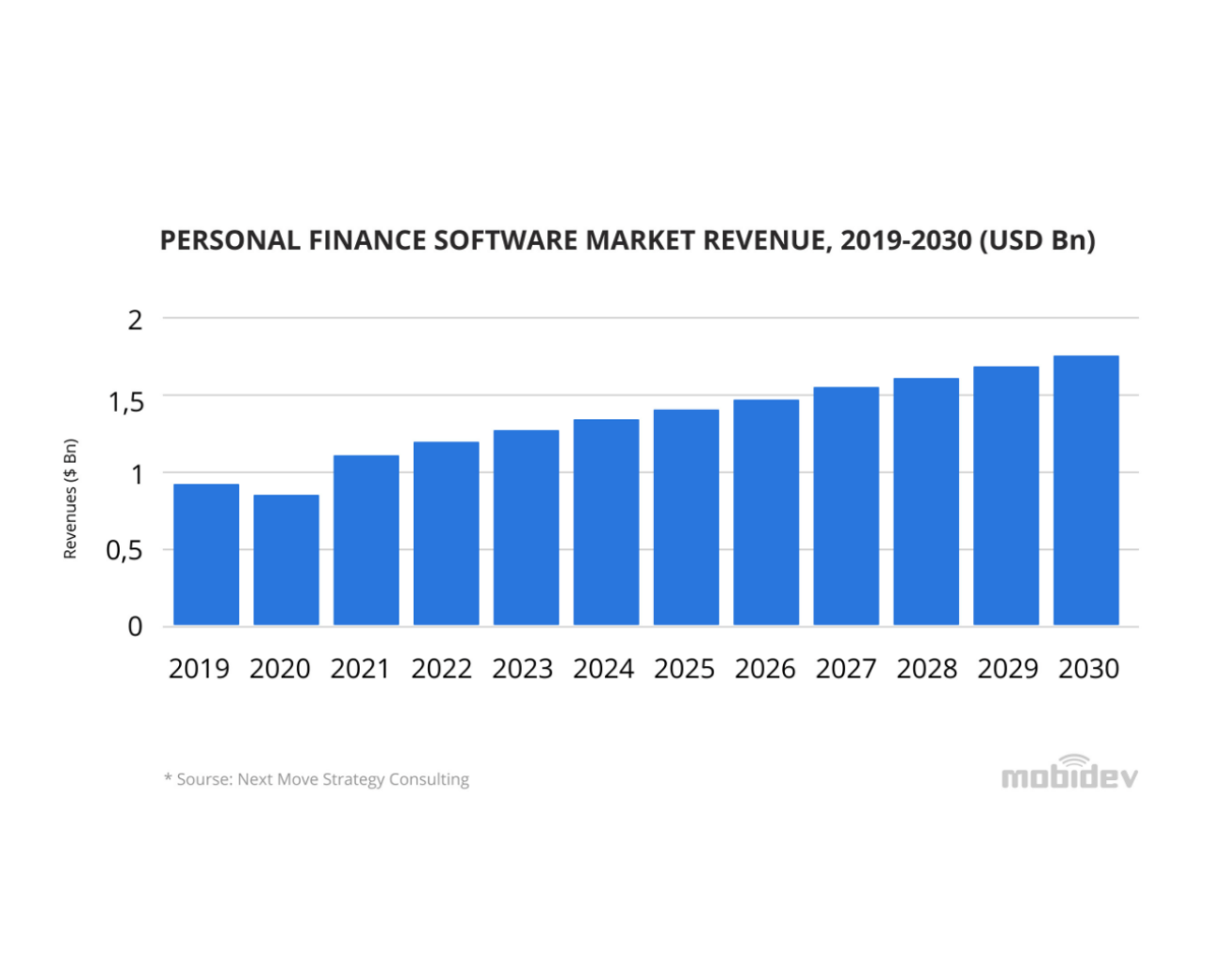

According to Verified Market Research, the global personal finance software market is expected to reach $1420.96 million by 2026, and according to NMSC this figure can grow to $1.80 billion by 2030, with a CAGR of 6.1% from 2020-2030.

If you were looking for a guide on how to build such an AI financial assistant app, then you are on the right page. Here you will find answers to the most common questions related to the development of a financial management application.

Personal Finance Market Overview 2022

The global economy has begun to recuperate from the Covid-19 outbreak, but full recovery is still a long way off. According to a Charles Schwab survey, 53% of Americans have been financially impacted by the pandemic. Against this background, the issue of effective personal finance management has become especially acute, and tools designed to help in this are in demand like never before.According to Verified Market Research, the global personal finance software market is expected to reach $1420.96 million by 2026, and according to NMSC this figure can grow to $1.80 billion by 2030, with a CAGR of 6.1% from 2020-2030.

One of the major trends in personal finance software is the use of AI technology. According to Mordor Intelligence, the global AI in the fintech market was valued at $7.91 billion in 2020 and is expected to reach $26.67 billion by 2026.

Artificial intelligence helps users of financial apps get the most out of their budgeting and investment planning. Personal finance software solutions, based on self-learning algorithms, allow you to customize financial recommendations based on the user’s spending behavior. Not surprisingly, a significant part of the personal finances market is occupied by robo advisors that provide automated financial planning solutions and AI-powered budgeting apps.

Personal financial assistants can be both standalone applications or software connected to personal banking accounts. In the second case, the user will get more opportunities to control and manage their expenses and incomes, since the software will automatically pull up the data such as transaction history.

The open banking standard, which is gaining popularity in the USA and Europe, allows the secure exchange of consumer data between banks and fintech applications with the consent of the user. This scenario helps automate the flow of data and get more meaningful insights for better financial advice. As of March 2021, there were 502 registered оpen banking third-party providers (TPP) in Europe. Also, according to Statista, in 2020 the number of open banking users in Europe was approximately 12.2 million and this figure is expected to reach 63.8 million users by 2024.

Artificial intelligence helps users of financial apps get the most out of their budgeting and investment planning. Personal finance software solutions, based on self-learning algorithms, allow you to customize financial recommendations based on the user’s spending behavior. Not surprisingly, a significant part of the personal finances market is occupied by robo advisors that provide automated financial planning solutions and AI-powered budgeting apps.

What is a Personal Financial Assistant App?

Personal financial assistant is an application that helps users manage their money more intelligently. Such an app can perform a wide range of tasks, from monitoring expenses and income to advising on the most suitable investment options. Some apps can also manage subscriptions and get better rates for your bills. For example, TrueBill automatically scans a user’s bills and looks for the best ways to save.Personal financial assistants can be both standalone applications or software connected to personal banking accounts. In the second case, the user will get more opportunities to control and manage their expenses and incomes, since the software will automatically pull up the data such as transaction history.

The open banking standard, which is gaining popularity in the USA and Europe, allows the secure exchange of consumer data between banks and fintech applications with the consent of the user. This scenario helps automate the flow of data and get more meaningful insights for better financial advice. As of March 2021, there were 502 registered оpen banking third-party providers (TPP) in Europe. Also, according to Statista, in 2020 the number of open banking users in Europe was approximately 12.2 million and this figure is expected to reach 63.8 million users by 2024.

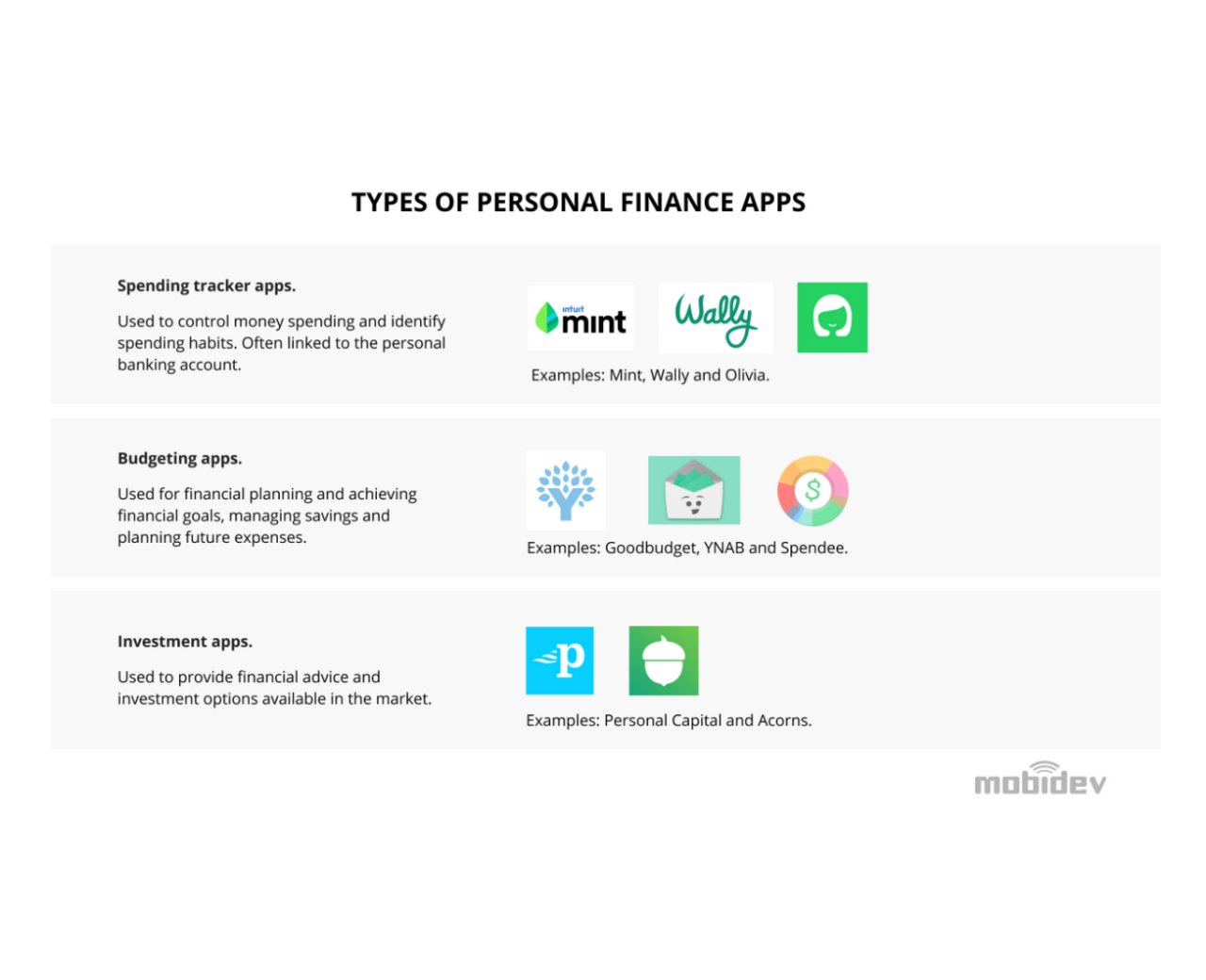

TYPES OF PERSONAL FINANCE APPS

Before diving into the question of how to build a personal finance app let’s find out what types of such software are on the market. Depending on the functions they provide, personal finance applications are divided as follows:

It is worth noting that most personal finance applications combine several types in one to provide a better user experience and offer comprehensive financial management services. What features to choose for your application is to be decided. We recommend looking at your business goals, the needs of your potential users and market trends to help in your determination.

According to IBM, 20% of data breaches are caused by compromised credentials. Biometric authentication technology is considered one of the most reliable ways to protect data. Modern algorithms can easily guess the correct password for an account, but they cannot fake the unique physical characteristics of users.

Biometrics technology can be implemented in the way of facial recognition, iris scanning, fingerprint identification, or voice verification. However, each option has its implementation features. For example, creating iris scanning on mobile and desktop is not possible without special hardware, since the resolution of conventional cameras is not enough.

According to Finances Online, facial recognition is one of the top three artificial intelligence technologies being adopted worldwide. Let’s find out how it works.

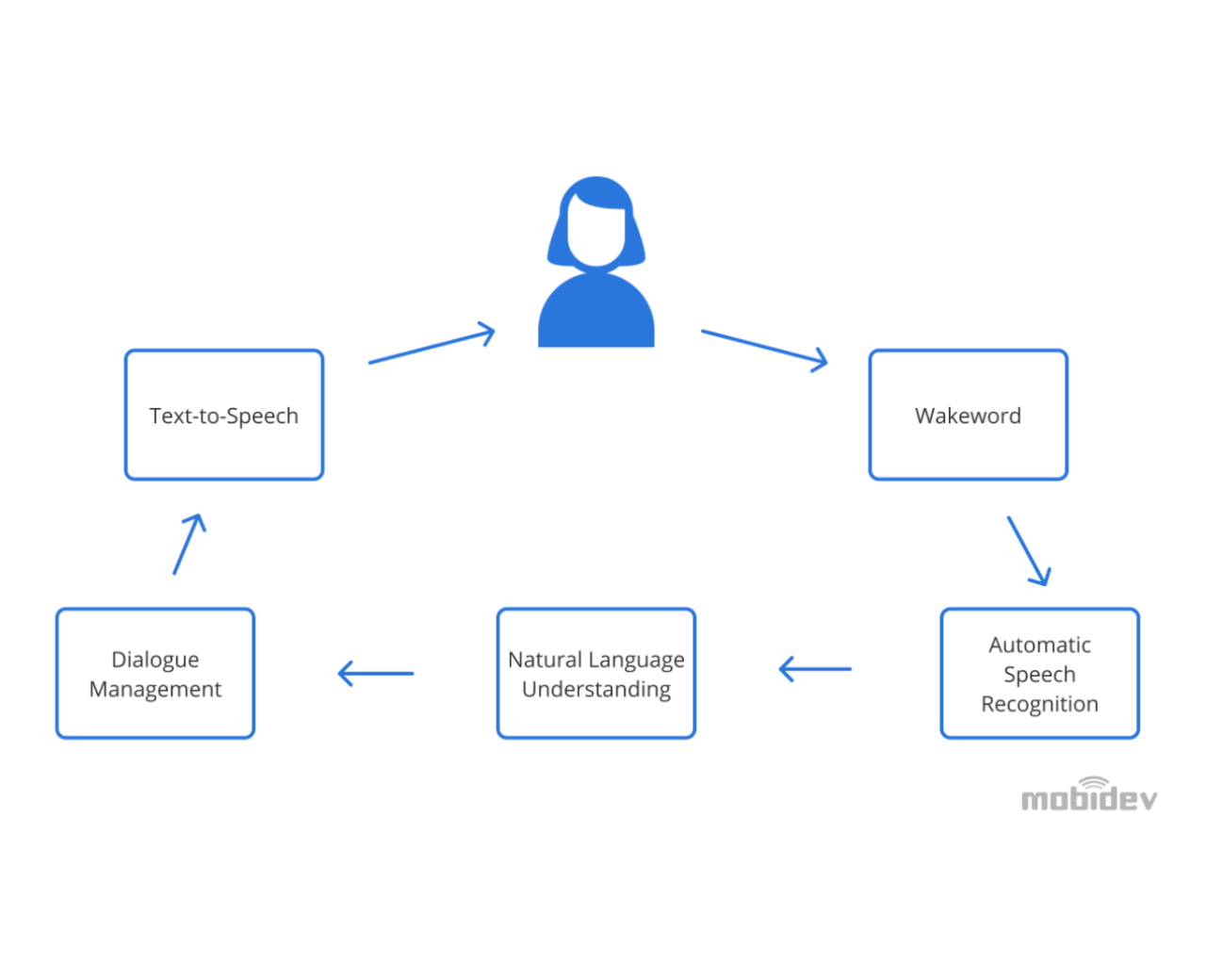

AI voice assistants use a device’s microphone to receive voice requests. First of all, they need to recognize a command (a wakeword) that helps wake up the device, since virtual assistants are usually passively listening. Further, after triggering, voice recognition, voice analysis and language processing go to work and the magic happens.

Key Features for Financial Assistant Application

To get a big picture of how to develop an AI personal financial assistant from the technical side, you must first create a preliminary list of features for your financial software solution. Let’s start with some functionality that forms the basis of any money management app. Here are features that users expect to see by default when downloading a financial assistant app and quick tips on how to implement them right:- Registration/Log In – Use two-factor authentication and biometrics to make sure that users’ log-in flow is secured and no unauthorized person can get into the account. Also, Single Sign-on (SSO) enables secure user authentication with one set of credentials to several applications.

- User profile – Take care of personalization to provide the best user experience. For example, let users personalize the app theme, choose notifications, etc.

- Tracking expenses – The data for the expense report can be taken from the transaction history if the application is connected to a bank account. However, integration is not always possible and depends on the country and banks. Some financial assistants offer receipt recognition features. You just need to take a photo of your receipt and the application will automatically convert it into an expense. As an example, Expensify can do this.

- Categorization and budgeting – Base categories breaking down monthly expenses (eg “food”, “housing”, “savings”, etc) can be set automatically, but we also recommend leaving users the option to create their own.

- Setting financial goals – Provide a range of predefined goals covering options such as paying off credit card debt or savings, leaving users the chance to create their own goals.

- Investment and savings – Let users automate their savings by setting spending limits or automatically saving their spare change from daily purchases. Some apps also offer users the services of their financial advisors, who analyze the client’s financial situation and suggest the best ways to invest and increase capital.

- Integration with banking accounts – You can find money management apps on the market without integration with bank accounts, such as Goodbudget, which only supports manual data entry. However, automation will bring much more value to users, saving them time and effort.

- Analytics and reports – Well-visualized reports will help users better track their financial transactions. Displaying data in charts and infographics makes the information clearer and more readable.

- Notifications and alerts – Notifications keep users updated about new savings opportunities, progress toward financial goals, or remind them of recurring payments such as taxes and rent. However, remember that notifications should be helpful and not annoying, so the best way is to allow users to choose which updates they want to receive.

Advanced AI-based Functionality

The line between an ordinary financial management app and a powerful financial assistant lies in the use of artificial intelligence. Designed correctly, AI assistants can become a full-fledged alternative to human financial consultants, providing an equal level of customer service. So let’s take a look at some advanced features based on this technology. Here are ways you can make your financial management application more intelligent.BIOMETRIC AUTHENTICATION

The issue of security cannot be overlooked when talking about building an app for the financial market. Security is one of the main decision factors for users when choosing a financial app. If you plan to connect your app with users’ bank accounts and credit cards, you must be sure that this process is completely secure and no user data will be lost or compromised. This is an area where artificial intelligence can show its full power.According to IBM, 20% of data breaches are caused by compromised credentials. Biometric authentication technology is considered one of the most reliable ways to protect data. Modern algorithms can easily guess the correct password for an account, but they cannot fake the unique physical characteristics of users.

Biometrics technology can be implemented in the way of facial recognition, iris scanning, fingerprint identification, or voice verification. However, each option has its implementation features. For example, creating iris scanning on mobile and desktop is not possible without special hardware, since the resolution of conventional cameras is not enough.

According to Finances Online, facial recognition is one of the top three artificial intelligence technologies being adopted worldwide. Let’s find out how it works.

- The device captures the incoming face image from the device’s camera in a 2D or 3D way, depending on the characteristics of the device.

- The system splits the face image into unique features (nose shape, the distance between eyes, etc.) and translates this into a unique code that displays the user’s facial signature.

- The system compares the incoming image signal with the information stored in the database in real-time.

- The system decides if the incoming image matches any picture in the database and allows or denies access.

CONVERSATIONAL ENGINE

Artificial intelligence is that magical tool that can turn software into a financial assistant that communicates with users in a human-like manner. Instead of looking up information in the app, the user can ask something like “Hey, what is my credit card balance?” and get a voice response. Conversational AI makes it possible. Based on Natural language processing (NLP) and Natural Language Understanding (NLU) technology, the conversational engine enables smooth communication between a financial app and its users. Let’s take a look at how it works.AI voice assistants use a device’s microphone to receive voice requests. First of all, they need to recognize a command (a wakeword) that helps wake up the device, since virtual assistants are usually passively listening. Further, after triggering, voice recognition, voice analysis and language processing go to work and the magic happens.

- Automatic Speech Recognition (ASR) converts a user-spoken query into a text transcription. However, in some cases, it is faster and easier to implement this feature through a chatbot that eliminates the ASR step.

- Natural language understanding (NLU) takes the transcription and predicts the user’s intent by recognizing syntax, context, language patterns, etc.

- Software analyzes the natural language audio signal converted into digital data and then compares this data with a database.

- The dialogue manager (DM) decides what to say to the user or what action to take.

- The assistant responds using the text-to-speech (TTS) feature.

A properly trained conversational engine makes a financial app easy to get along with and increases user engagement while interacting with the app. The development of such a module requires deep expertise in artificial intelligence and machine learning algorithms.

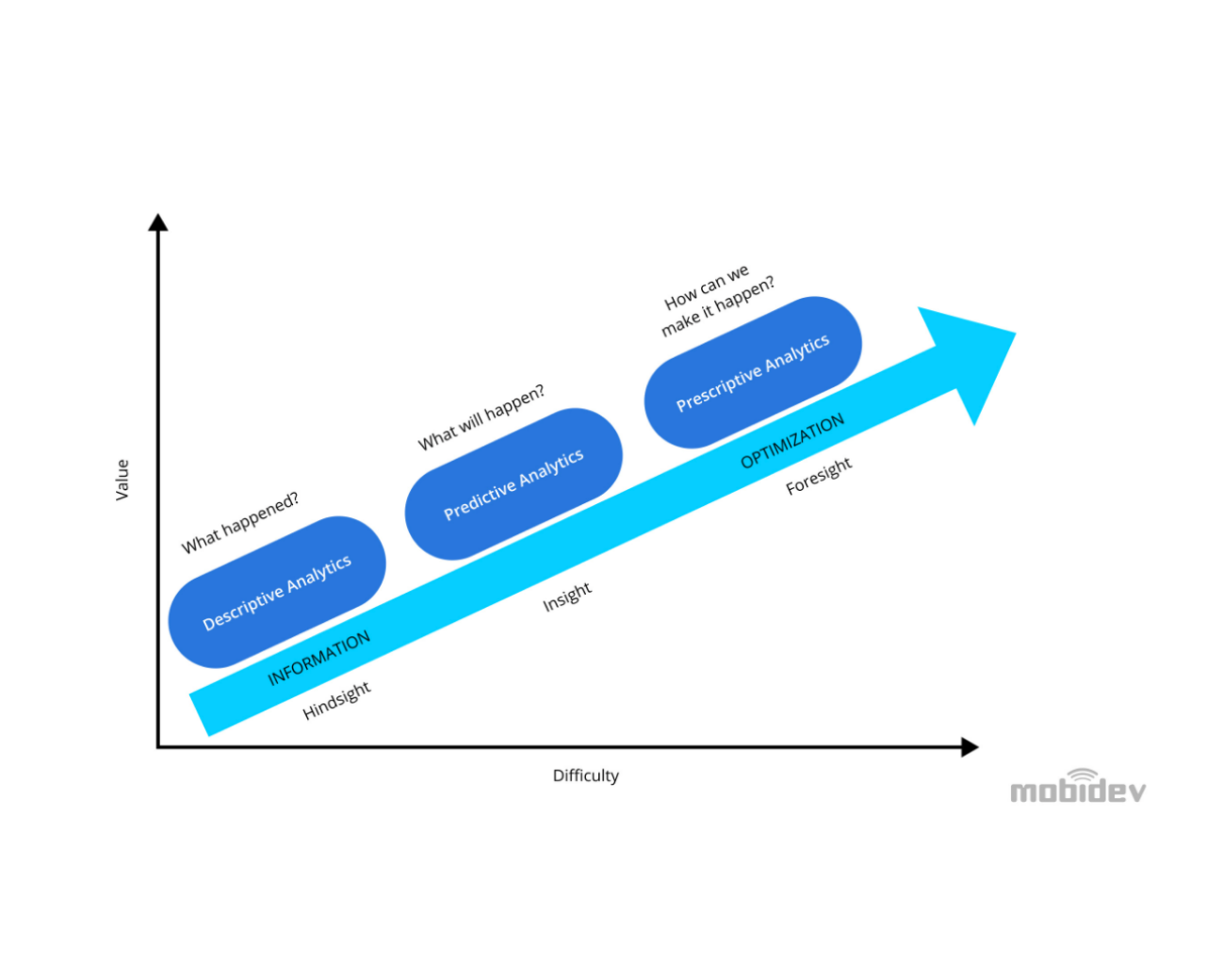

PREDICTIVE AND PRESCRIPTIVE ANALYTICS MODULES

Another powerful AI capability for building fintech applications is predictive technology. Thanks to it, personal finance assistant apps can detect user behavior patterns as well as make predictions on future users’ income and expenses. This happens thanks to statistics and modeling techniques. Predictions are made based on historical data of account transactions powered by machine learning algorithms. Predictive analytics will let users plan for the future and tell them how best to achieve their financial goals acting like a real financial advisor.

When it comes to providing recommendations and financial advice, prescriptive analytics comes into play. Basically, this technology takes what predictive analytics has learned and goes one step further by determining the best course of action in a given situation. However, you should know that this analytics module is quite a complex solution that requires extensive industry and technology knowledge and a large amount of historical data.

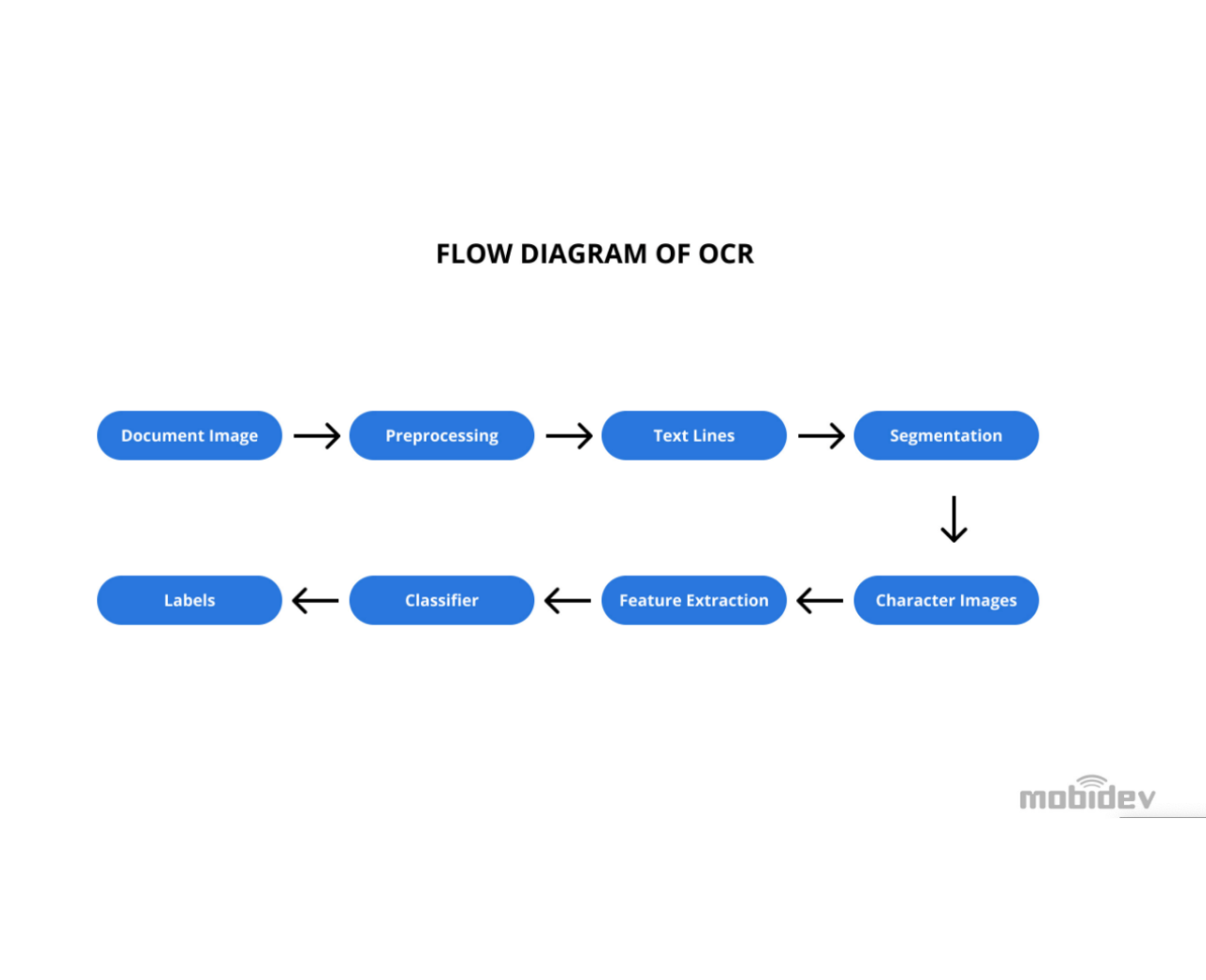

To provide recognition of the receipt, the system extracts the text from the photo of your receipt and analyzes it to determine which data corresponds to the categories embedded in the system, such as date, amount, currency, and the like. After that, the module analyzes existing spending categories and looks for suitable ones in order to add information from a new receipt.

RECEIPT RECOGNITION

If you want to develop a personal finance assistant app like Expensify, you’ll need a recipient recognition feature that will allow you to scan receipts and automatically enter expenses into the app. Expensify provides the SmartScan feature based on optical character recognition technology (OCR) that enables the data-entry process and translates scanned images into text. It reads the merchant, date and amount of the transaction, creates an expense and enters this data into the expense report. Sounds easy right? However, from a technical point of view, the process looks much more complicated.To provide recognition of the receipt, the system extracts the text from the photo of your receipt and analyzes it to determine which data corresponds to the categories embedded in the system, such as date, amount, currency, and the like. After that, the module analyzes existing spending categories and looks for suitable ones in order to add information from a new receipt.

The main challenge of implementing this feature is that receipts can be represented in different formats, which complicates the analysis of information and its further distribution. This is where you need effective machine learning models. AI and ML will allow you to avoid errors occurring in the process of data conversion and effectively process different types of documents thanks to advanced algorithms. Also, a common solution is to implement a built-in system that allows you to manually correct the OCR output data to get a more accurate result.

The integration of the application with the bank takes place using Application Programming Interfaces (APIs), a software that enables data transmission between the two parties. The concept of open banking, which is gaining momentum around the world, makes it a fairly easy process. This model allows traditional financial institutions and fintech startups to cooperate based on open APIs provided by banks. Open banking APIs solutions allow the application to integrate with bank accounts and customize the flow of necessary data for efficient use in financial planning. This approach has replaced screen scraping, where users provide their bank account login ID and password to third parties without the bank’s knowledge, putting their accounts at risk.

Open banking encourages banks to develop their own open APIs that make it possible to create new financial products based on them. Thus, traditional banks enrich their list of services and support competition in the market. Financial managing apps can operate based on open banking in the UK (UK Open Banking Standard), European Union (PSD2), Australia (Australia’s Consumer Data Right Act) and some other regions.

For example, Europe Payment Services Directive Two (PSD2) obligated every licensed bank in the EU to provide its open banking APIs to third-party developers and fintech firms. In Australia in 2020, the Big Four Banks were also legally required to make customer account information available upon request. The USA doesn’t yet have legislation governing open banking, although some banks are initiating the development of their own open APIs, realizing the benefits and security of this approach. BBVA, Citibank and Capital One are among them.

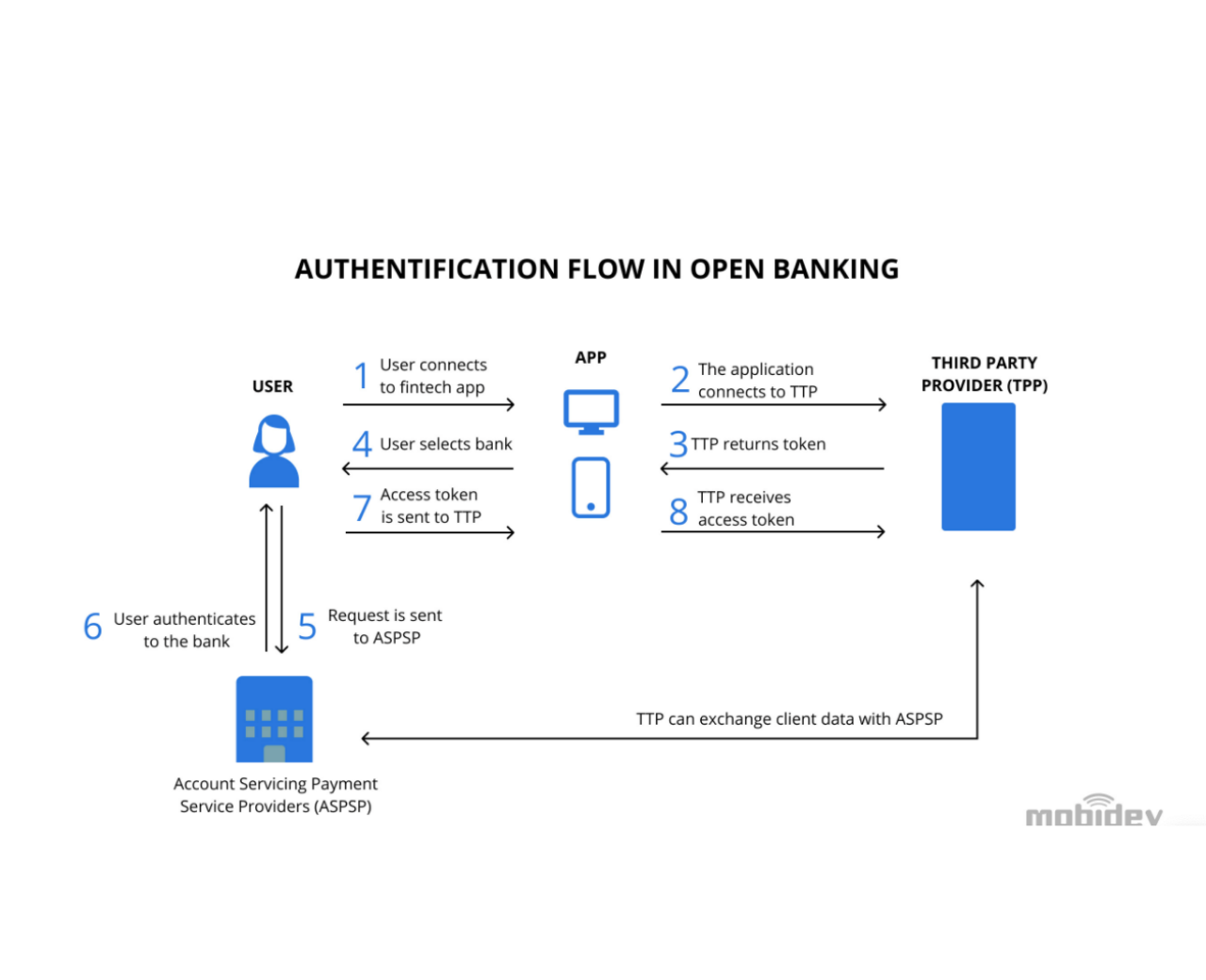

Further, when using your application, users will independently have to confirm access to their bank account using the functionality connected by the developers. Here’s how it works:

Connecting a Financial Management App to Banking Accounts

If you are looking for the answer oh how to create a budget planning app, you should remember that linking the AI financial assistant app with bank accounts opens up a lot of benefits for users. This way, they can get some valuable insights about their expenses and incomes automatically without the need for manual data entry. So how do you provide users with the ability to connect your fintech app to their accounts?The integration of the application with the bank takes place using Application Programming Interfaces (APIs), a software that enables data transmission between the two parties. The concept of open banking, which is gaining momentum around the world, makes it a fairly easy process. This model allows traditional financial institutions and fintech startups to cooperate based on open APIs provided by banks. Open banking APIs solutions allow the application to integrate with bank accounts and customize the flow of necessary data for efficient use in financial planning. This approach has replaced screen scraping, where users provide their bank account login ID and password to third parties without the bank’s knowledge, putting their accounts at risk.

Open banking encourages banks to develop their own open APIs that make it possible to create new financial products based on them. Thus, traditional banks enrich their list of services and support competition in the market. Financial managing apps can operate based on open banking in the UK (UK Open Banking Standard), European Union (PSD2), Australia (Australia’s Consumer Data Right Act) and some other regions.

For example, Europe Payment Services Directive Two (PSD2) obligated every licensed bank in the EU to provide its open banking APIs to third-party developers and fintech firms. In Australia in 2020, the Big Four Banks were also legally required to make customer account information available upon request. The USA doesn’t yet have legislation governing open banking, although some banks are initiating the development of their own open APIs, realizing the benefits and security of this approach. BBVA, Citibank and Capital One are among them.

HOW DO OPEN BANKING APIS WORK?

With the open banking regime, financial app developers can find the bank’s APIs in open access and set up data transfer functionality. To do this, they need to get an API key for identification and setting access permissions, and follow the API documentation to connect the application.Further, when using your application, users will independently have to confirm access to their bank account using the functionality connected by the developers. Here’s how it works:

- A user gives an app permission to access their data and act on their behalf by pressing the “I agree” button in the app.

- The application generates a token representing this consent, which is time-limited and contains access rights requirements.

- The app authenticates with the bank and sends the user’s token.

- The user receives a request from his bank to authorize the token and does so.

- The bank grants the application access to the user’s data.

Plaid is one of the most popular platforms of this type. The company works with hundreds of banks and fintechs in North America and Europe. For example, Truebill, Expensify and Cleo use the Plaid service to connect with financial institutions. Nordigen and Trulayer are Plaid alternatives for Europe.

What to Look for When Creating an AI Assistant for Finance?

The technical side of creating an AI financial assistant is closely related to other aspects of bringing the application to the market. Here are some points that you also need to focus on.REGULATORY COMPLIANCE

The question of regulatory compliance can be quite challenging for a fintech startup founder as the regulatory landscape differs from region to region.For example, the United States, which is the leader in the number of fintech startups in the world, still doesn’t have a single framework for managing the fintech sector. Therefore, when developing applications for this market, you need to study the local regulations of a particular state, also taking into account the federal legislation covering financial services such as Anti-Money Laundering (AML) regulations, Gramm-Leach Bliley Act (GLBA), etc.

In Europe, your application must be compliant with the General Data Protection Regulation (GDPR), ensuring users’ consent to access their data, and KYC/AML, which ensures preventing money fraud and terrorist financing. PSD2, which obliges banks to provide open APIs for third-party access, also imposes other requirements on financial service providers. If your application is associated with any type of payment service in the European Union, it must comply with certain requirements, for example, the use of multi-factor authentication for user login.

Also, it’s worth mentioning the EU Artificial Intelligence Act proposed by the European Commission at the end of 2021. The AI Act aims to establish a set of rules for AI-powered products on the EU market. In particular, the law contains a “product safety framework” built around a set of 4 risk categories. It establishes requirements for entering the market and certifying high-risk AI systems, which include solutions like product security components, credit scoring, evidence reliability assessment, and others that may be considered a clear security threat or violation of human rights. The regulation has not yet entered into use, but it should also be taken into account when developing an AI-based software thinking of the future.

We highly recommend that you study the regulatory environment of the region for which you are creating a financial app in order to comply with all requirements and implement the appropriate features in your product.

EXPERIENCED AI DEVELOPERS

Virtual financial assistant app development requires not only an understanding of the industry but deep expertise in artificial intelligence and machine learning. AI app development is not as easy as it seems. Creating efficient algorithms and working with advanced technologies cannot be learned in theory, it requires practice and constant knowledge updating. Therefore, you need to look for a reliable development team that will turn a financial application into an intelligent indispensable assistant for your customers.How to hire experienced AI engineers? Look for proven experience in developing and training machine learning models, as well as expertise in data science since AI works with large amounts of data. Also, take an interest in examples of AI-powered projects implemented by the team. There are people behind every project, so choose the right people to bring your business idea to life.

________________________________________________________________________________________________________________________

The full article is originally published at mobidev and is based on MobiDev technology research and experience providing software development services.

How MobiDev Can Help You

MobiDev has been helping visionaries around the globe transform business systems for over 12 years. Focusing on advanced technologies like machine learning and artificial intelligence, data science, augmented reality and the Internet of Things, our team knows how to meet different business goals and achieve maximum results. The expertise of MobiDev specialists has been proven by the successful implementation of hundreds of software development projects, and the company has repeatedly entered the top AI/ML providers according to Clutch, Techreviewer and GoodFirms.

At MobiDev, we follow a clear delivery flow that includes deep project research before starting work. This allows us to make sure that the team and the client share the goals of the project and have a common idea of the result.

More than 400 specialists are ready to start developing your fintech application. Learn more about MobiDev AI/ML services or contact us directly by submitting the form below to

The full article is originally published at mobidev and is based on MobiDev technology research and experience providing software development services.

How MobiDev Can Help You

MobiDev has been helping visionaries around the globe transform business systems for over 12 years. Focusing on advanced technologies like machine learning and artificial intelligence, data science, augmented reality and the Internet of Things, our team knows how to meet different business goals and achieve maximum results. The expertise of MobiDev specialists has been proven by the successful implementation of hundreds of software development projects, and the company has repeatedly entered the top AI/ML providers according to Clutch, Techreviewer and GoodFirms.

At MobiDev, we follow a clear delivery flow that includes deep project research before starting work. This allows us to make sure that the team and the client share the goals of the project and have a common idea of the result.

More than 400 specialists are ready to start developing your fintech application. Learn more about MobiDev AI/ML services or contact us directly by submitting the form below to